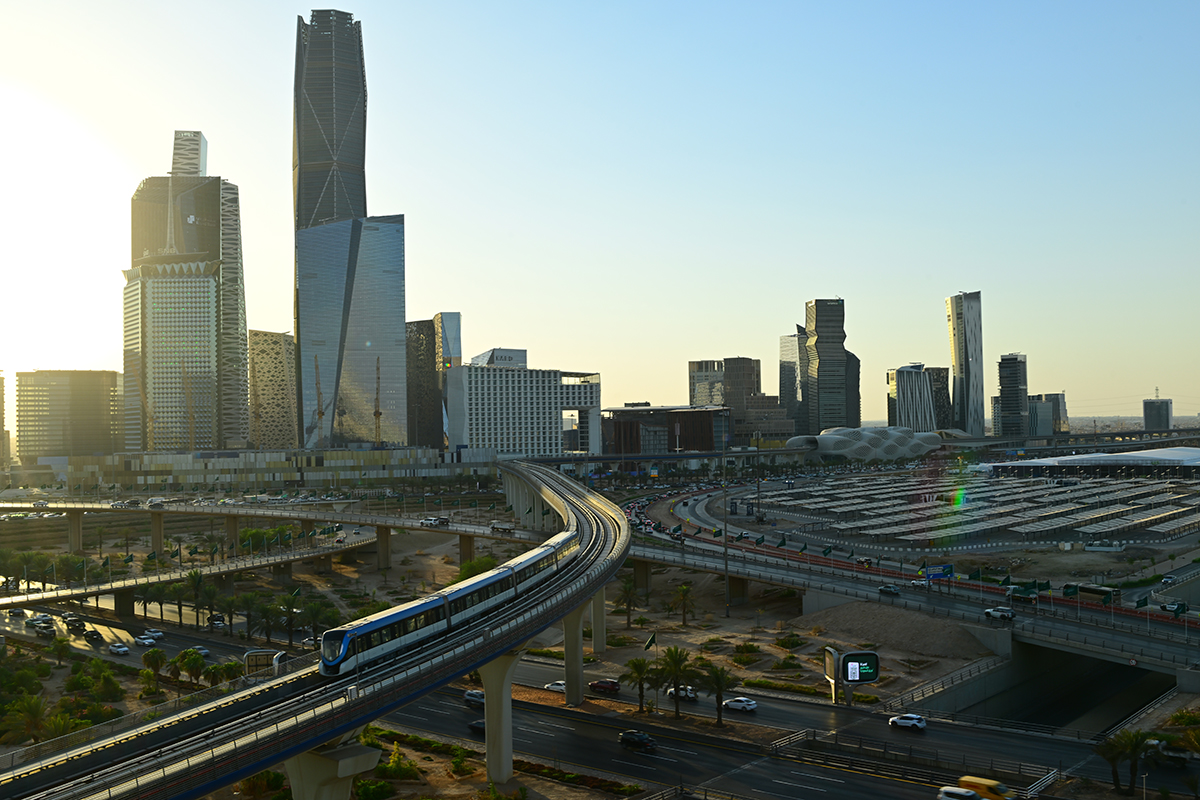

US Infrastructure Giant Stonepeak Expands Middle East Footprint With Saudi Arabia Office

Stonepeak, which claims to be the world’s largest independent infrastructure firm and leading US infrastructure investor, announced the opening of an office in Riyadh as part of its plans to establish its presence in Saudi Arabia and expand its footprint in the Middle East.

The Saudi foray follows the US company securing a license from the Saudi Ministry of Investment to operate non-securities business activities in the Kingdom.

Stonepeak also named senior investment professionals Steven Ciobo and Fadi Kerbaj to lead the company’s engagement on the ground in Riyadh.

Stonepeak enters Saudi market

The company said it remains focused on deepening strategic partnerships and identifying compelling investment opportunities across the infrastructure landscape in the region.

Mike Dorrell, Stonepeak CEO, Chairman, and Co-Founder, said Saudi Arabia is one of the world’s most exciting areas for infrastructure investment and innovation with a unique combination of strong, ambitious, well-resourced leadership and a young, educated, and fast-growing population.

“Stonepeak is market leading in creating and building infrastructure businesses in fast-growing economies, and we look forward to ramping up our service as a valuable partner for stakeholders in the Kingdom,” he said.

Hajir Naghdy, Senior Managing Director and Head of Asia and the Middle East at Stonepeak, said deepening the commitment to the Kingdom of Saudi Arabia is a critical next step in the company’s Middle East strategy.

Steven Ciobo joined Stonepeak in 2020 after serving in the Australian Parliament for nearly two decades and holding numerous senior roles as a Cabinet Minister, including as Minister for Trade, Tourism, and Investment, and as Minister for Defence Industry.

Fadi Kerbaj is a senior leader on Stonepeak’s investment team bringing 15 years of extensive infrastructure investment experience and a deep regional network to the firm having spent the majority of his career in infrastructure investment and advisory roles in the Middle East.

Most recently, Fadi was the Head of Saudi Arabia for Tribe Infrastructure, where he led a broad range of strategic transactions across district cooling, water, waste, and social infrastructure, and prior to Tribe he invested in similar sectors across the region through his role at Macquarie.

In addition to its presence in the Kingdom, Stonepeak employs more than 300 people in New York, Houston, London, Hong Kong, Seoul, Singapore, Sydney, Tokyo, and Abu Dhabi.

The firm manages approximately $73 billion in assets from regulated centres on behalf of its partners.

Digital Payments Dominate Saudi Arabia As Cash Use Continues To Decline, Visa Says

Visa research shows 80% of transactions in Saudi Arabia are now digital, highlighting accelerating consumer shift away ... Read more

Saudi Venture Capital Surges 145 Per Cent To $1.72bn In Record 2025

Saudi Arabia leads MENA venture capital for a third year, with 2025 investment reaching $1.72bn across a record 257 dea... Read more

GCC Debt Market Tops $1.1trn As Dollar Issuance Surges – Report

Fitch Ratings says GCC debt capital markets grew 14% in 2025, led by US dollar borrowing and record sukuk activity The ... Read more

Humain Secures $1.2bn To Fuel Saudi AI Push

Saudi Arabia's state-backed AI firm secures financing to build 250 megawatts of data centre capacity, as the kingdom ra... Read more

Global FDI Jumps 14% In 2025 To $1.6 Trillion, UNCTAD Says

Data centre projects topped $270 billion in 2025, making up more than one fifth of global greenfield investment, as sem... Read more

UAE Tax Compliance In 2026: All You Need To Know

Experts warn that deeper audits, stricter documentation requirements and the rollout of e-invoicing will reshape tax op... Read more