Digital Payments Dominate Saudi Arabia As Cash Use Continues To Decline, Visa Says

Digital payments are continuing to reshape consumer behaviour in Saudi Arabia, with cash playing a shrinking role in everyday transactions, according to new research from Visa.

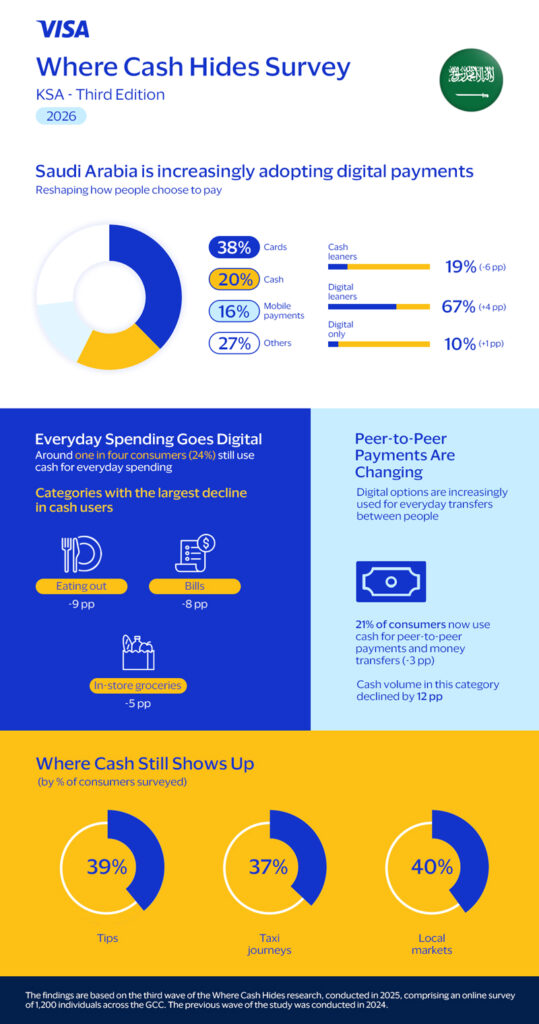

Visa’s third edition of its Where Cash Hides report shows that 80 per cent of transactions in the Kingdom are now conducted digitally. The study found that 67 per cent of Saudi consumers are largely non-cash users, relying primarily on payment cards or mobile devices for most of their purchases.

This marks an increase of 4 percentage points compared with the previous year, underlining the pace of the shift away from cash.

Saudi consumers go increasingly cashless

Mobile payments are gaining particular momentum, accounting for 16 per cent of all transactions. Visa said the growing adoption reflects increasing consumer preference for faster, more secure and more convenient payment methods, supported by wider acceptance among merchants and improvements in digital infrastructure.

The use of cash continues to decline across several traditionally cash-heavy categories. Visa’s research showed reduced cash usage for eating out, down 9 per cent, and for bill payments, down 8 per cent. While cash remains present in some day-to-day spending, its role is narrowing as digital options become more widely available and trusted.

Cash is now most commonly used for peer-to-peer transactions, with 39 per cent of consumers still paying tips in cash. It is also used for some peer-to-peer services, cited by 28 per cent of respondents, and for property rent payments, where 14 per cent reported continuing reliance on cash.

Ali Bailoun, Senior Vice President and Group Country Manager for Saudi Arabia, Bahrain and Oman at Visa, said: “The data shows a steady move toward digital payments in Saudi Arabia. Such progress is possible only because banks, fintechs, merchants and technology partners are pushing together in the same direction, in line with the Kingdom’s Vision 2030.

“As more people try mobile and card payments in their daily lives and their expectations evolve, too. Consumers want payment options that are quick, convenient, and safe. When digital solutions meet these expectations, they naturally become the preferred choice.”

Visa said the growing reliance on digital payments is driven by a combination of convenience, security and added value. Debit and credit cards offer greater transparency and ease of use than cash, while reducing the risks associated with carrying physical money. Mobile payments add further security through tokenisation, which replaces sensitive card details with unique digital identifiers.

The research also highlighted the appeal of rewards programmes, cashback offers and travel or lifestyle benefits linked to card usage, which continue to influence consumer preferences in the Kingdom.

The findings are based on an online survey of 1,200 respondents across the GCC conducted in 2025.

Dubais Magellan Capital Launches Flagship $975m Hedge Fund

Dubai-based manager is opening its absolute return platform to third-party capital for the first time The post Dubai’... Read more

UAEs FAB Posts 22% Jump In Q4 Profit, Beats Estimates

UAE's biggest bank FAB reported a record 2025 profit after strong Q4 results, higher non-interest income and expanding ... Read more

Dubai Unveils $27.2bn DIFC Zabeel District In Landmark Financial Hub Expansion

Dubai unveils $27.2bn DIFC Zabeel District, a landmark expansion set to reshape the city’s financial hub amid global ... Read more

Saudi Venture Capital Surges 145 Per Cent To $1.72bn In Record 2025

Saudi Arabia leads MENA venture capital for a third year, with 2025 investment reaching $1.72bn across a record 257 dea... Read more

GCC Debt Market Tops $1.1trn As Dollar Issuance Surges – Report

Fitch Ratings says GCC debt capital markets grew 14% in 2025, led by US dollar borrowing and record sukuk activity The ... Read more

Humain Secures $1.2bn To Fuel Saudi AI Push

Saudi Arabia's state-backed AI firm secures financing to build 250 megawatts of data centre capacity, as the kingdom ra... Read more