UAEs Crypto Regulation Offers Model For Others As New Report Reveals Rising Extremist Funding In Europe: Experts

The UAE’s regulatory framework is emerging as a potential model for combating illicit finance as crypto adoption continues to grow globally, just as a new report reveals alarming shifts in how extremist groups are raising digital funds across Europe.

“By establishing clear guidelines and licensing requirements, the UAE has created an enabling environment where legitimate crypto businesses can operate while maintaining controls against illicit finance,” a Chainalysis spokesperson told Arabian Business.

“This clarity encourages industry participants to implement robust compliance programs and monitoring systems.”

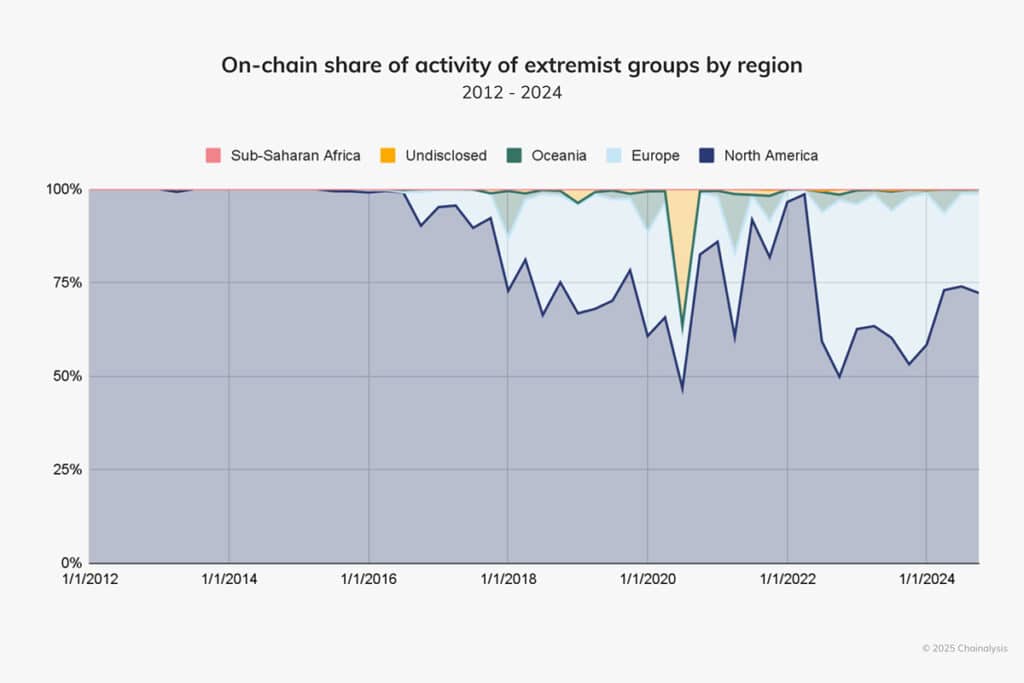

The blockchain intelligence firm’s latest report shows that while global crypto donations to extremist groups are declining overall, Europe has emerged as a new hotspot, capturing nearly half of all such transactions between 2022 and 2024.

“Europe has seen a steady growth in inflows to extremist groups,” the spokesperson explained. “This is likely driven by a rise in extremist ideologies and groups that have successfully used divisive narratives to attract funding in increasingly polarized political climates.”

The report highlights how political events are increasingly being exploited for fundraising. “We also saw a trend in donations surging around major political events, such as the several elections that took place around Europe in 2024,” Chainalysis said.

While North America still leads in absolute terms with over $20 million in total contributions, the sophistication of European fundraising campaigns has reached new levels. White nationalist and nationalist groups are leading this surge, followed by conspiracy theorists and organisations promoting anti-Semitism.

The global regulatory response has begun to take shape. “We have seen the US sanction Nordic Resistance Movement as a Specially Designated Global Terrorist, and the EU, Australia, Canada and other jurisdictions sanction The Base, a neo-Nazi accelerationist group,” the spokesperson said.

Monitoring extremist crypto activities

For financial hubs like the UAE, the report’s findings underscore the importance of robust monitoring systems. “Blockchain analysis tools can enable regulators and law enforcement to gain proactive oversight on extremist activity,” the spokesperson explained. “While overall amounts of extremist crypto funding remains small, any amount is concerning given that it could be financing propaganda, recruitment or violence.”

The research reveals that after facing restrictions from traditional banking services, many groups are turning to privacy coins like Monero or moving their fundraising operations underground. The Daily Stormer, a neo-Nazi website, now exclusively accepts privacy-focused cryptocurrencies after being removed from traditional hosting services.

The regulatory challenge is particularly complex because these groups often operate in legal grey areas that vary by jurisdiction. What’s banned outright in Germany might be protected speech in the United States, creating enforcement gaps that extremist groups exploit.

The findings come as the UAE continues to strengthen its position as a global crypto hub while maintaining strict controls against illicit finance. This balanced approach to regulation, combining innovation with strong oversight, could provide valuable lessons for other jurisdictions as they confront the evolving challenges of extremist crypto financing.

DIFC Courts Embrace Blockchain Tools For Complex Digital Asset Cases

New custodial and analytics services will allow judges and litigants to better manage disputes involving cryptocurrenci... Read more

UAE Announces Major Changes To Corporate Tax Rules

Changes explain how corporate tax liabilities are settled and give businesses the right to claim payments in certain ca... Read more

Kuwait To Launch Dedicated Banking Crimes Prosecution Office In 2026

New unit in Kuwait will target cyber fraud, cheque offences and financial forgery as authorities step up protection of ... Read more

Islamic Development Bank Approves $1.365bn Financing In 12 Countries

To support development projects, including renewable energy, power networks, transport corridors, water and agricultura... Read more

UAE Tops MENA Crypto Adoption And Ranks 5th Worldwide – Report

World Crypto Rankings 2025 highlights the UAE’s rise as a regional leader in digital assets and tokenisation, with Du... Read more

ADIO, Primavera To Collaborate To Attract High-growth Companies To Abu Dhabi

The partnership will increase cross-border capital flows, deepen investor partnerships and expand the footprint of glob... Read more