UAE Launches Buy Now, Pay Later Option For Fees And Fines Through Tabby

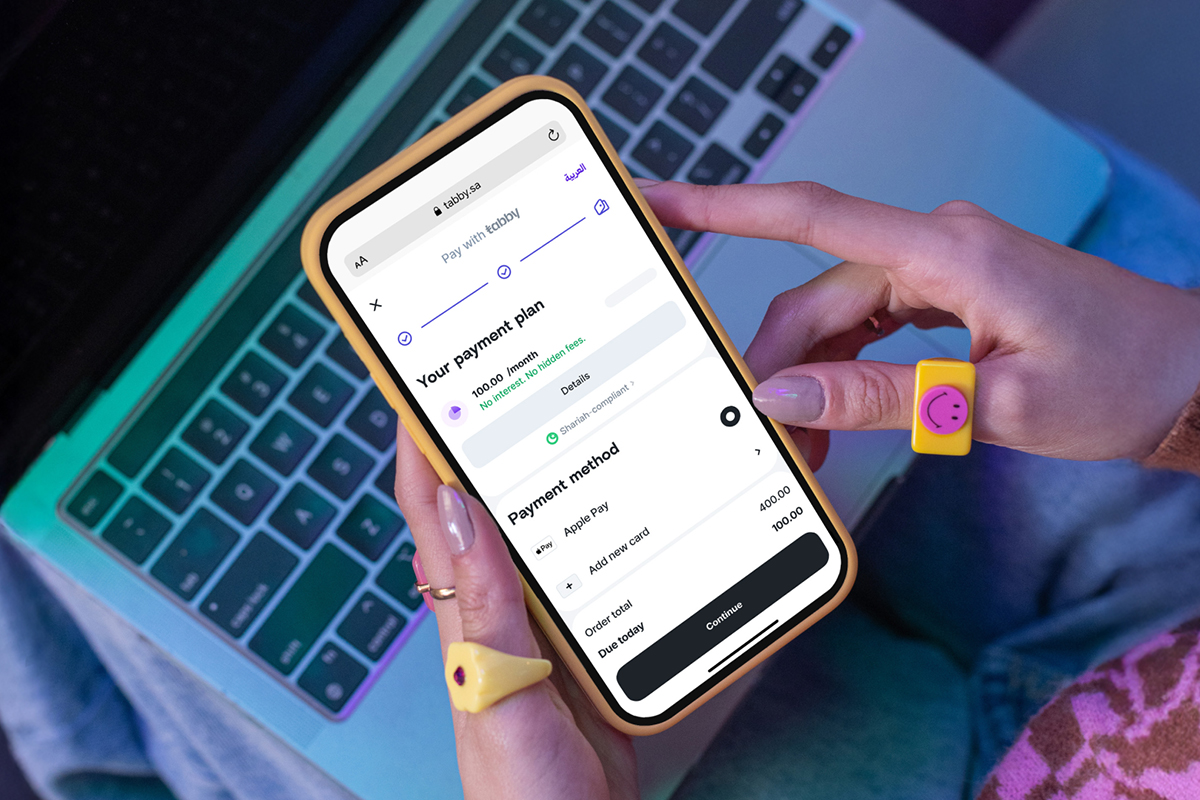

The UAE Ministry of Finance (MoF) has launched a new payment service in partnership with Tabby, enabling customers to pay federal government service fees and fines through authorised instalment channels based on the “Buy Now, Pay Later” model.

The collaboration marks the Ministry’s first partnership with Tabby, a leading financial and shopping services company operating across the Middle East and North Africa region.

The initiative aims to simplify the settlement of federal fees and fines through flexible monthly instalments, improving customer experience while enhancing the efficiency of the federal financial collection system.

UAE buy now, pay later service

Under the partnership, customers dealing with federal entities will be able to pay in instalments, with Tabby covering the full amount of the fees or fines upfront to the relevant government entity.

Customers will then repay Tabby according to pre-agreed terms.

MoF confirmed that it has secured the best possible commission rate for this service, which will be borne only by customers choosing to use the instalment option.

The partnership expands the range of electronic payment solutions available nationwide and supports ongoing efforts to advance financial inclusion and digital transformation.

Digital payments

Saeed Rashid Al Yateem, Assistant Under-Secretary for Government Budget and Revenue Sector at the Ministry of Finance, said the partnership reflects the Ministry’s commitment to adopting modern financial technologies that support federal revenue management and enhance customer satisfaction.

He stressed that the initiative gives customers a more flexible and secure way to meet financial obligations to government entities, improving overall collection efficiency.

He added: “This collaboration represents a paradigm shift in the ongoing modernisation of payment systems across federal entities. We are committed to adopting innovative solutions and strategic partnerships that contribute to building an integrated and sustainable financial infrastructure.

“This initiative will boost our efforts to modernise payment systems through innovation and strategic collaboration.”

Hosam Arab, Co-founder and CEO of Tabby, said, “This partnership marks a significant step forward for Tabby as we continue expanding our services to include the federal government sector. Our mission has always been to provide customers with greater financial flexibility, and we are proud to support the Ministry of Finance in making federal services more accessible across the UAE.”

Partnership covers all federal entities

The new service will apply across all federal entities, offering customers greater flexibility in managing their financial obligations. It builds on the Ministry’s efforts to introduce pioneering digital initiatives that simplify procedures, enhance transparency and connect federal entities through a unified, advanced platform.

These efforts contribute to improving federal revenue management and strengthening integration across electronic financial services within an integrated digital system.

Dubais Magellan Capital Launches Flagship $975m Hedge Fund

Dubai-based manager is opening its absolute return platform to third-party capital for the first time The post Dubai’... Read more

UAEs FAB Posts 22% Jump In Q4 Profit, Beats Estimates

UAE's biggest bank FAB reported a record 2025 profit after strong Q4 results, higher non-interest income and expanding ... Read more

Dubai Unveils $27.2bn DIFC Zabeel District In Landmark Financial Hub Expansion

Dubai unveils $27.2bn DIFC Zabeel District, a landmark expansion set to reshape the city’s financial hub amid global ... Read more

Digital Payments Dominate Saudi Arabia As Cash Use Continues To Decline, Visa Says

Visa research shows 80% of transactions in Saudi Arabia are now digital, highlighting accelerating consumer shift away ... Read more

Saudi Venture Capital Surges 145 Per Cent To $1.72bn In Record 2025

Saudi Arabia leads MENA venture capital for a third year, with 2025 investment reaching $1.72bn across a record 257 dea... Read more

GCC Debt Market Tops $1.1trn As Dollar Issuance Surges – Report

Fitch Ratings says GCC debt capital markets grew 14% in 2025, led by US dollar borrowing and record sukuk activity The ... Read more