UAE Announces Two Tiers Of Sugar Tax Starting The New Year

Grandmums the world over would warn that sugar will cause a hole in your teeth. Now it will also make one in your pocket.

From 1 January 2026, sugar may not taste that sweet in your beverages, as the UAE Ministry of Finance announced it would levy as much as AED1.09 per litre tax, based on sugar content in these drinks.

Sugar tax is part of a GCC-wide decision. Saudi Arabia has also said it will start taxing from 1 January, but it is yet to reveal the details.

The amendment is part of the UAE’s ongoing efforts to promote public health and encourage healthier consumption habits across the community.

The UAE Ministry issued Cabinet Decision No. 197 of 2025 on selective goods, the tax rates or amounts imposed on them, and the method for calculating the selective price. This replaces Cabinet Resolution No. 52 of 2019 on Excise Goods and their applicable tax rates.

Applicable taxes

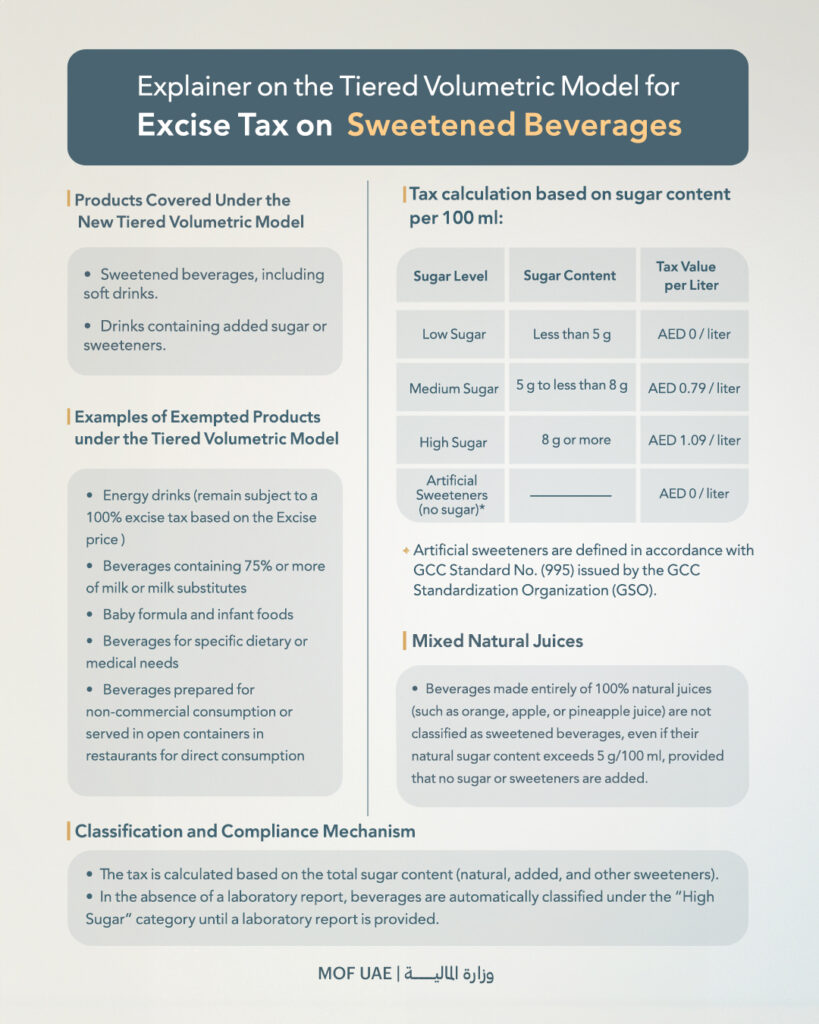

The Ministry is implementing ‘tiered volumetric model’ taxes on sweetened beverages. The tax rate is determined by the sugar content per 100 millilitres.

Beverages containing between five and eight grams of sugar per 100ml will be taxed at AED0.79 per litre, while those containing eight grams or more of sugar (per 100ml) will be taxed at AED1.09 per litre.

The Ministry has exempted beverages with less than five grams of sugar per 100ml, as well as those containing only artificial sweeteners, from taxation.

The procedure

In an effort to make it easier for all taxable persons to understand, comply with, and fulfill their obligations, the decree aims to establish a unified legislative framework that clearly defines excise goods and their applicable tax rates.

The resolution also outlines the Federal Tax Authority’s procedures for classifying products, including their addition to the official price list, as well as the steps to be taken when taxable persons fail to submit the required laboratory reports or supporting documentation.

In such cases, the tax shall be applied according to the highest sugar content category and may later be revised upon submission of an approved laboratory report.

The Ministry of Finance said that apart from the government’s commitment to promoting public health, these taxes will reduce the financial burdens associated with diseases linked to excessive sugar consumption.

Digital Payments Dominate Saudi Arabia As Cash Use Continues To Decline, Visa Says

Visa research shows 80% of transactions in Saudi Arabia are now digital, highlighting accelerating consumer shift away ... Read more

Saudi Venture Capital Surges 145 Per Cent To $1.72bn In Record 2025

Saudi Arabia leads MENA venture capital for a third year, with 2025 investment reaching $1.72bn across a record 257 dea... Read more

GCC Debt Market Tops $1.1trn As Dollar Issuance Surges – Report

Fitch Ratings says GCC debt capital markets grew 14% in 2025, led by US dollar borrowing and record sukuk activity The ... Read more

Humain Secures $1.2bn To Fuel Saudi AI Push

Saudi Arabia's state-backed AI firm secures financing to build 250 megawatts of data centre capacity, as the kingdom ra... Read more

Global FDI Jumps 14% In 2025 To $1.6 Trillion, UNCTAD Says

Data centre projects topped $270 billion in 2025, making up more than one fifth of global greenfield investment, as sem... Read more

UAE Tax Compliance In 2026: All You Need To Know

Experts warn that deeper audits, stricter documentation requirements and the rollout of e-invoicing will reshape tax op... Read more