Saudi Arabia-headquartered financial services app Tabby confirmed the completion of a secondary sale of shares held by existing investors, resulting in an implied company valuation of $4.5 billion.

The transaction involved HSG, Boyu Capital and other investors acquiring shares from existing shareholders. No new shares were issued and Tabby did not receive proceeds from the sale.

Hosam Arab, CEO and Co-Founder at Tabby said: “We’re proud to welcome our new shareholders who share Tabby’s ambitions and the impact we’re making on financial services across the region.”

Rock Wang, Managing Director at HSG said: “Tabby’s product velocity and rapid path to scalability reflect exceptional execution and a deep understanding of the market. We’re excited to partner with management as they continue to build a comprehensive financial services flywheel in a region with tremendous growth potential.”

Joey Chen, Partner at Boyu Capital said: “Tabby has demonstrated strong product innovation and disciplined growth in a rapidly developing market, placing the company as the forefront leader in this region’s nascent financial technology sector. We are excited to partner with Hosam and the Tabby team as they build the next generation of financial services in the Middle East.”

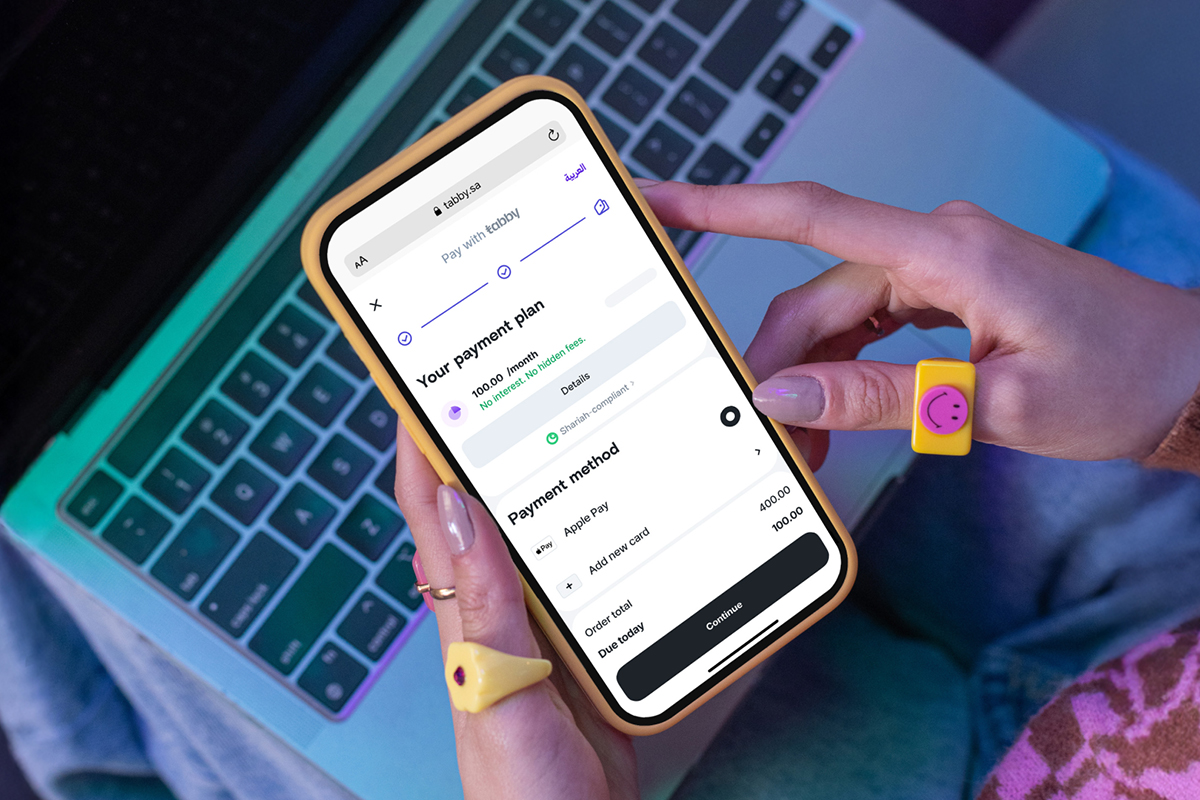

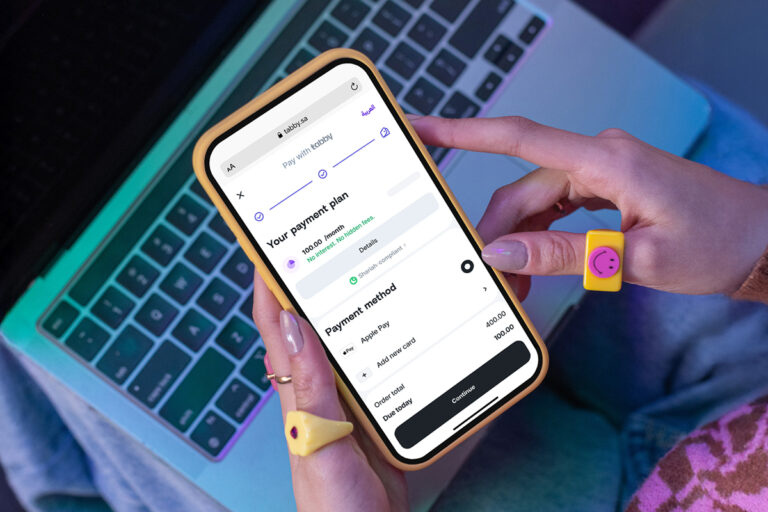

Tabby provides flexible payment solutions to over 40,000 global brands and small businesses, including SHEIN, Amazon, Adidas, IKEA, H&M, Samsung, and Noon. The company serves customers in Saudi Arabia, the UAE, and Kuwait.