NEOM announced the successful closing of a landmark export credit agency (ECA) financing transaction with Italy’s SACE, securing approximately $3bn under a long-term multicurrency united facility.

The deal, which marks NEOM’s first corporate ECA financing and the largest united financing ever guaranteed by SACE, will support various projects across NEOM and is backed by a syndicate of nine prominent international banks:

- HSBC

- Banco Bilbao Vizcaya Argentaria

- Bank of China

- Crédit Agricole CIB

- Agricultural Bank of China

- Citi

- China Construction Bank

- J.P. Morgan

- Bank of America

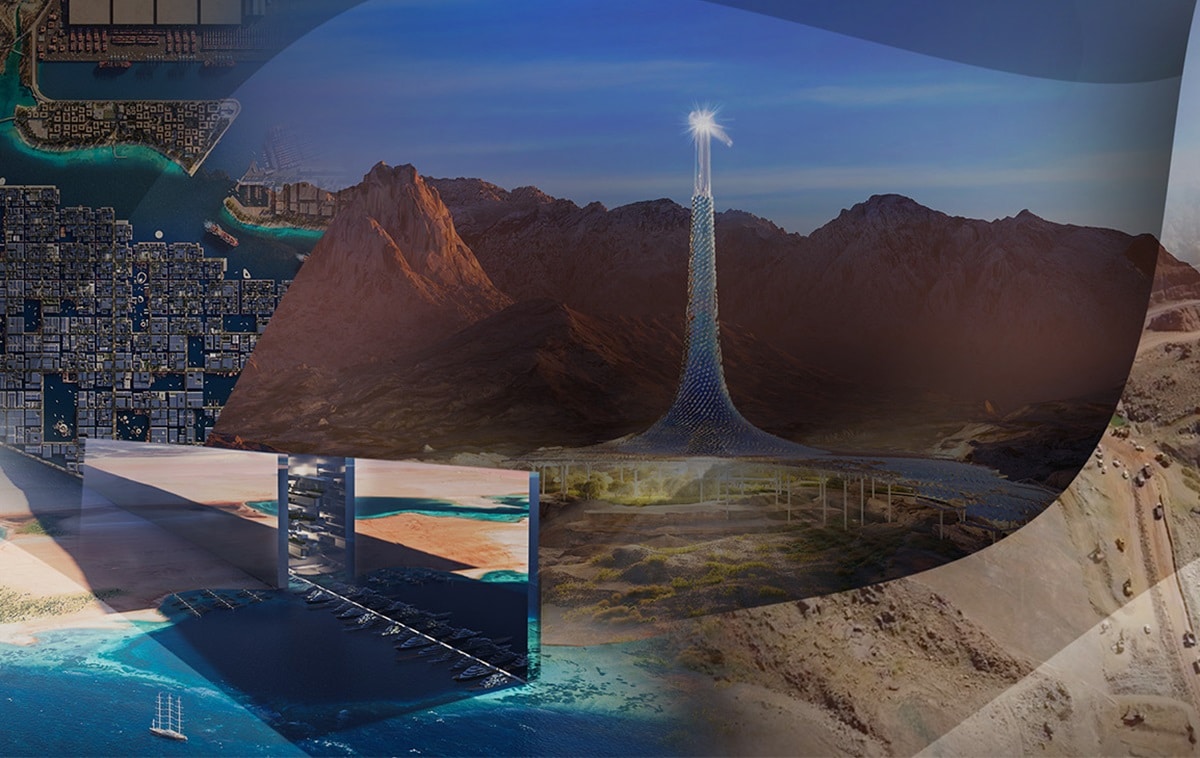

The partnership will enable NEOM to leverage supplies from Italian businesses, particularly small and medium enterprises (SMEs), to support the project’s development across key sectors, such as infrastructure, urban development, construction and transport (rail, road and maritime).

NEOM finance deal

To date, Italian suppliers and contractors have supported NEOM on a range of projects, with contracts worth SR6.3bn ($1.7bn), and the deal aims to further strengthen and develop these important international business relationships.

NEOM acting chief executive Eng. Aiman Al Mudaifer said that NEOM is committed to working with global partners who share its passion for visionary projects and initiatives that will advance human progress.

Al Mudaifer said: “This deal will support us in delivering our significant portfolio of developments and reflects the strong confidence that leading financial institutions worldwide place in NEOM. It advances the Kingdom’s aim of generating capital investment in line with Saudi Vision 2030, with foreign investment being instrumental in diversifying the economy.

“This partnership with SACE and the consortium of leading international banks also creates strong ties with major Italian companies that will enhance international trade and investment flows”.

Meanwhile, SACE chief executive Alessandra Ricci expressed pleasure for her company to play our part alongside NEOM in this cutting-edge project, which generates opportunities in a wide range of sectors for Italian SMEs and supply chains.

Ricci said: “Opening new routes to ‘Made in Italy’ is a priority to allow a long-term growth for Italian exports, matching their potential. Our Riyadh office supports Italian companies and their potential partners and counterparties, by providing experience and insurance financial solutions combined with the added value of a physical presence in the area”.

The SACE united facility expands and diversifies NEOM’s existing funding pool, supporting its long-term financing requirements as NEOM moves forward in the development of major projects and regions.