Du Pay Tops AED 1.5bn In Digital Transactions As UAE Pushes Towards Cashless Future

du Pay, the digital financial services arm of telecom operator du, has exceeded AED1.5bn in processed transactions in under two years, a milestone the company says reflects both its own momentum and the UAE’s broader shift towards a cashless economy.

The platform, launched to provide accessible banking-style services to residents who may not meet traditional account requirements, has seen strong uptake among the country’s diverse expatriate population.

du Pay said its offering supports the Dubai Department of Finance’s ambition to make 90 per cent of all transactions in the emirate cashless by 2026.

du Pay transactions

Fahad Al Hassawi, chairman of du Pay, said: “Reaching AED 1.5 billion in transactions represents our commitment to financial inclusion and digital transformation in the UAE. We aim to empower residents to participate fully in the digital economy and offering comprehensive digital payment solutions, while supporting the nation’s vision for a cashless future.”

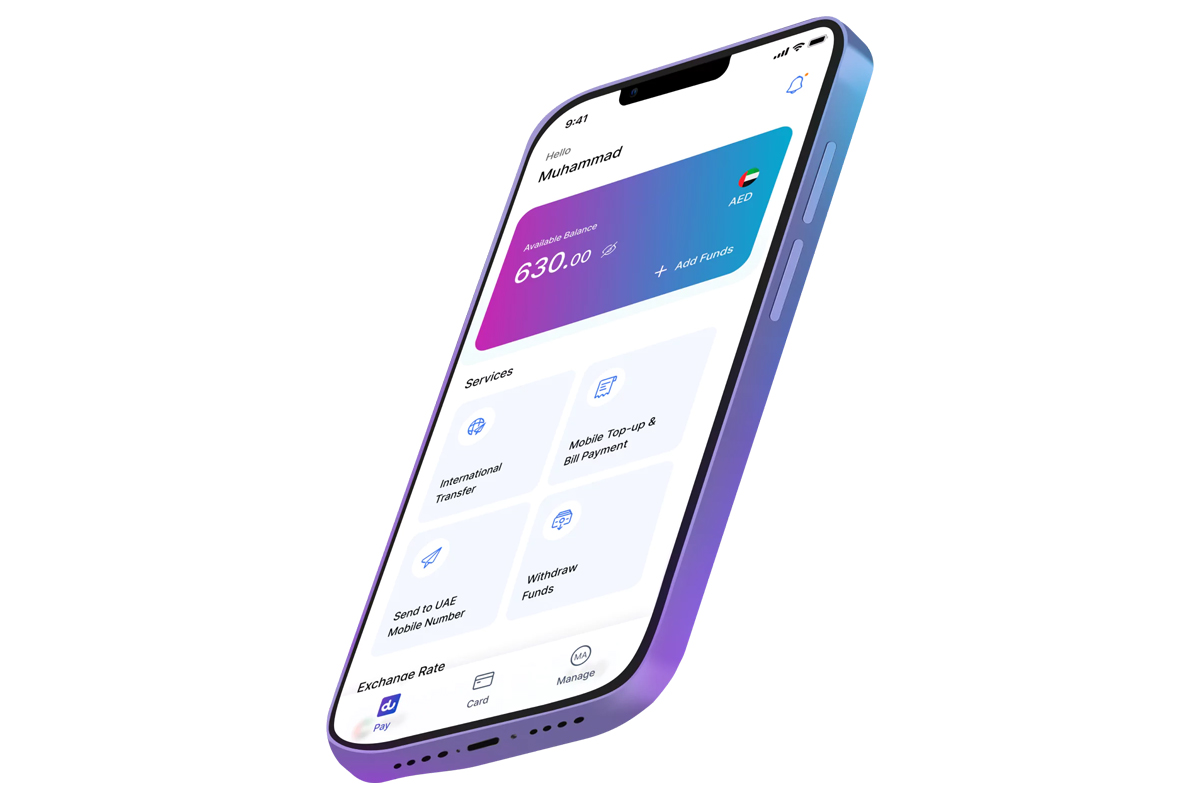

The company positions du Pay as a simple, secure and inclusive tool for managing money. Users can onboard instantly using Emirates ID and facial recognition, access the app in multiple languages and complete day-to-day financial tasks without traditional banking barriers.

The service provides customers with a free IBAN, enabling salary deposits via local bank transfers, and does not require a minimum balance.

According to du Pay, the app has surpassed one million downloads and has facilitated payments, mobile top ups, bill settlements and cardless cash withdrawals. The firm said customers can send money to more than 200 countries at competitive rates, reflecting its focus on the remittance needs of expat workers.

The company also highlights its Central Bank of the UAE licensing and security infrastructure as key elements in building trust among new users. Promotional incentives, including free mobile data on recharges or international transfers and gold coin giveaways, have contributed to engagement, with more than 300 customers already receiving gold coins.

FinTech growth

du Pay said its growth has been driven by serving underbanked communities that have historically faced limited access to financial services. The platform argues that its model supports national digital transformation goals by offering an alternative pathway into the formal financial system.

The milestone underscores du Pay’s emergence as an active player in the UAE’s fast-growing fintech sector, where digital payments adoption continues to accelerate across both consumer and business segments.

Dubais Magellan Capital Launches Flagship $975m Hedge Fund

Dubai-based manager is opening its absolute return platform to third-party capital for the first time The post Dubai’... Read more

UAEs FAB Posts 22% Jump In Q4 Profit, Beats Estimates

UAE's biggest bank FAB reported a record 2025 profit after strong Q4 results, higher non-interest income and expanding ... Read more

Dubai Unveils $27.2bn DIFC Zabeel District In Landmark Financial Hub Expansion

Dubai unveils $27.2bn DIFC Zabeel District, a landmark expansion set to reshape the city’s financial hub amid global ... Read more

Digital Payments Dominate Saudi Arabia As Cash Use Continues To Decline, Visa Says

Visa research shows 80% of transactions in Saudi Arabia are now digital, highlighting accelerating consumer shift away ... Read more

Saudi Venture Capital Surges 145 Per Cent To $1.72bn In Record 2025

Saudi Arabia leads MENA venture capital for a third year, with 2025 investment reaching $1.72bn across a record 257 dea... Read more

GCC Debt Market Tops $1.1trn As Dollar Issuance Surges – Report

Fitch Ratings says GCC debt capital markets grew 14% in 2025, led by US dollar borrowing and record sukuk activity The ... Read more