UAE Announces Tax Exemption; Expected Holiday Dates; Dubai Real Estate Cryptocurrency Buying Tips; Visa Application Centre Opened – 10 Things You Missed This Week

The UAE has revealed new tax guidelines, industrial investment plans and visa and transport projects this week.

At the same time real estate analysts have focussed on cryptocurrency and proptech developments in Dubai, with major announcements and buying tips hitting the headlines.

Catch up on 10 of the biggest stories this week, as selected by Arabian Business editors.

UAE announces tax exemption

The UAE has announced an exemption on Corporate Tax for certain foreign entities.

The Ministry of Finance (MoF) has announced the issuance of Cabinet Decision No. (55) of 2025 on Exempting Certain Persons from Corporate Tax for the purposes of Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses.

The decision expands the scope of the corporate tax exemption to include foreign entities that are wholly owned by certain exempted entities, such as government entities, government-controlled entities, qualifying investment funds, and public pension or social security funds.

Dubai to slash journey times on major road with new bridge

The new bridge will serve residential communities in Nad Al Sheba and provide direct connection for inbound traffic from Dubai–Al Ain Road towards Al Ain.

With a design capacity of 2,600 vehicles per hour, the bridge reduces travel time from Dubai–Al Ain Road to Nad Al Sheba by 83 per cent, cutting the journey from six minutes to just one.

UAE holidays 2025: Will residents get a long weekend ahead of Islamic New Year?

If confirmed by UAE authorities, the public holiday would align with the country’s Saturday–Sunday weekend, potentially offering a three-day break from June 27 to 29.

As with all Hijri calendar-based holidays, the official date depends on the moon sighting and will be confirmed closer to the time.

Dubai launches $1.2bn PropTech Hub to power future real estate

Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, Deputy Prime Minister, Minister of Defence, Chairman of The Executive Council of Dubai, and Chairman of the Higher Committee for Future Technology and Digital Economy, chaired a meeting of the Committee and issued directives to launch The Dubai PropTech Hub.

The move seeks to fast-track the expansion of the PropTech market in the emirate, aiming to more than double its value to surpass AED4.5bn ($1.2bn) over the next five years.

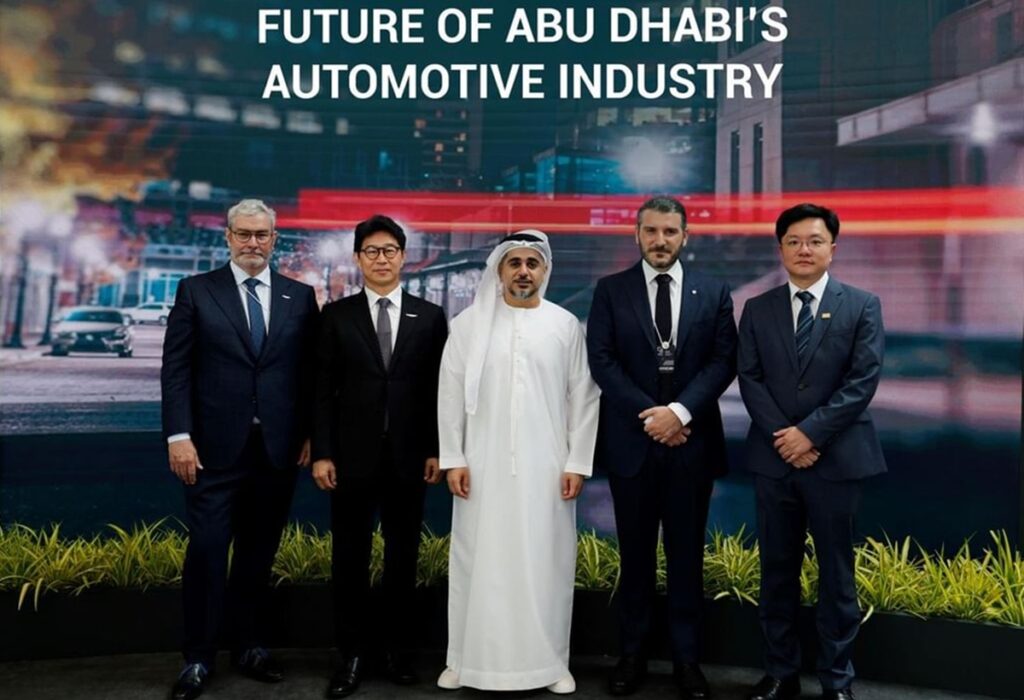

Abu Dhabi announces car manufacturing plans as it eyes $27bn automotive plan and 7,000 skilled jobs

The Abu Dhabi Investment Office (ADIO) announced the launch of a major economic programme targeting the establishment of an end-to-end automotive ecosystem. Backed by multi-billion-dirham investments from global industry leaders, the programme aims to transform Abu Dhabi into the region’s foremost hub for smart automotive manufacturing and assembly, R&D, restoration, auctions and luxury automobiles.

Announced during the Make it in the Emirates Forum 2025 (MIITE), the automotive programme is projected to contribute AED100bn ($27.2bn) to Abu Dhabi’s GDP by 2045, attract more than AED8bn ($2.2bn) in FDI and create 7,000 high-skilled jobs.

Umm Al Quwain an ‘investment hotspot’ in UAE, say real estate experts

The northern emirate, known for its 23 km of coastline and natural landscapes, is experiencing increased investor interest as neighbouring property markets reach maturity and price points that exclude many buyers.

In an exclusive interview with Arabian Business, Andrew Cummings, Head of Residential Agency at Savills Middle East, attributes the growth to a broader trend of investment focus shifting to the northern emirates.

Off-plan real estate sales in Dubai have already reached $24.5bn this year as high returns and easy finance lure investors

The findings, based on data from the Dubai Land Department, indicated that the Dubai real estate market witnessed 40,500 off-plan property transactions between January and May 15, 2025.

The AED90bn ($24.5bn) total, making 38 per cent of total market sales. Ready-built properties, which recorded AED147.4bn ($40.1bn), accounted for 62 per cent of sales during the same period. According to the data, off-plan transactions included 36,359 residential units and 4,141 buildings.

World’s largest visa application opens in Dubai with 10,000-per-day capacity

VFS Global launched its flagship Visa Application Centre in Wafi City, marking the opening of the largest visa application facility in the world.

At nearly 150,000sq ft, the centre is equipped to handle up to 10,000 visa applications daily, a capacity that stands as the highest for any single location, and is supported by a skilled and diverse team of over 400 trained professionals from more than 25 nationalities.

The pros and cons of buying Dubai real estate with cryptocurrency

With the UAE’s proactive approach to blockchain and digital asset regulation, Dubai is now one of the few cities in the world where cryptocurrency can be used to legally and securely purchase residential and commercial real estate.

As more developers and buyers embrace crypto payments, the conversation is shifting from “Is this possible?” to “What are the risks and rewards?” – whether you’re a seasoned crypto investor or a newcomer to Dubai’s property market.

Emirates NBD gets RBI go-ahead to set up wholly owned subsidiary in India

Setting up a wholly owned unit will allow Emirates NBD to be treated on par with local banks.

A statement by the RBI on Monday said: “Emirates NBD Bank is currently carrying on banking business in India in branch mode through its branches located in Chennai, Gurugram and Mumbai. The in-principle approval has been granted to the bank for setting up a WOS through the conversion of its existing branches in India. The RBI would consider granting a licence for commencement of banking business in WOS mode under Section 22 (1) of the Banking Regulation Act, 1949 to Emirates NBD Bank PJSC, on being satisfied that the bank has complied with the requisite conditions laid down by the RBI.”

Dubais Magellan Capital Launches Flagship $975m Hedge Fund

Dubai-based manager is opening its absolute return platform to third-party capital for the first time The post Dubai’... Read more

UAEs FAB Posts 22% Jump In Q4 Profit, Beats Estimates

UAE's biggest bank FAB reported a record 2025 profit after strong Q4 results, higher non-interest income and expanding ... Read more

Dubai Unveils $27.2bn DIFC Zabeel District In Landmark Financial Hub Expansion

Dubai unveils $27.2bn DIFC Zabeel District, a landmark expansion set to reshape the city’s financial hub amid global ... Read more

Digital Payments Dominate Saudi Arabia As Cash Use Continues To Decline, Visa Says

Visa research shows 80% of transactions in Saudi Arabia are now digital, highlighting accelerating consumer shift away ... Read more

Saudi Venture Capital Surges 145 Per Cent To $1.72bn In Record 2025

Saudi Arabia leads MENA venture capital for a third year, with 2025 investment reaching $1.72bn across a record 257 dea... Read more

GCC Debt Market Tops $1.1trn As Dollar Issuance Surges – Report

Fitch Ratings says GCC debt capital markets grew 14% in 2025, led by US dollar borrowing and record sukuk activity The ... Read more